Biblically Responsible Investing Is Booming and LGBTQ Americans Are Paying the Price

The Christian-faith investing movement is a key factor driving American companies away from their DEI efforts.

On Jan. 7, Meta introduced a new and watered-down Hateful Conduct Policy, which now makes explicit exemptions for discrimination aimed at the LGBTQ community. “We do allow allegations of mental illness or abnormality when based on gender or sexual orientation, given political and religious discourse about transgenderism and homosexuality,” the policy states, using an offensive, loaded term that anti-trans activists frequently use. The LGBTQ community and allies were outraged, with many boycotting Facebook and Instagram because of it.

But for Robert Netzly’s company, the new guidelines were a massive win: “Meta’s decision to end its censorship and divisive DEI policies represents a watershed moment for free expression, corporate responsibility, and faith-based investing,” wrote Netzly, the CEO of Inspire Investing, in a blog post a few days after the announcement.

“We had been engaged with Meta for about eight months … with a shareholder resolution centered on censorship,” Netzly, who describes himself as a “blood-bought believer by Jesus Christ,” told Uncloseted Media. “I applaud [Meta] for listening. I applaud them for engaging with us and I applaud them for making a good decision,” he says, adding in his blog post that Inspire’s shareholder engagement efforts “were instrumental in speaking biblical truth to corporate power and contributed to steering Meta toward a more inclusive, free and God-glorifying society.” Meta did not respond to Uncloseted Media’s request to view the shareholder resolution, and Inspire Investing declined to share a copy.

Inspire Investing, founded by Netzly in 2015, is one of several financial firms specializing in what’s known as biblically responsible investing (BRI)—a rapidly growing, socially conservative form of Christian faith-based investing that steers Christians, no matter how well-intentioned they may be, away from investing in companies that support or promote various LGBTQ rights or inclusive policies for the community.

“The whole idea of biblically responsible investing is a relatively new concept that doesn't get a lot of attention,” says Kent Saunders, a professor of economics and finance at Anderson University.

While BRI may be new, this form of investing is a key factor pushing companies to sprint away from diversity, equity and inclusion (DEI) efforts.

And the industry is booming. Netzly says his company has over $3.2 billion of assets under management, up from the $35 million they had eight years ago. “We're growing like a weed. And not just us, but many others. So it really is just the beginning of the faith-based investment movement.”

How BRI Works

Inspire Investing and other BRI firms, like the Biblically Responsible Investing Institute (BRII) and the Timothy Plan, screen companies for various forms of support for the LGBTQ community. Depending on the BRI firm, companies can get dinged for celebrating Pride Month, for offering benefits to same-sex couples, for having an LGBTQ employee resource group and for covering top or bottom surgery for their trans employees.

“When you’re talking about a company that is comprised of thousands of people with various viewpoints, we can’t take sides in a social issue,” says Netzly. “Particularly in something so deeply important and impactful as marriage, sexuality, relationships [and] gender.”

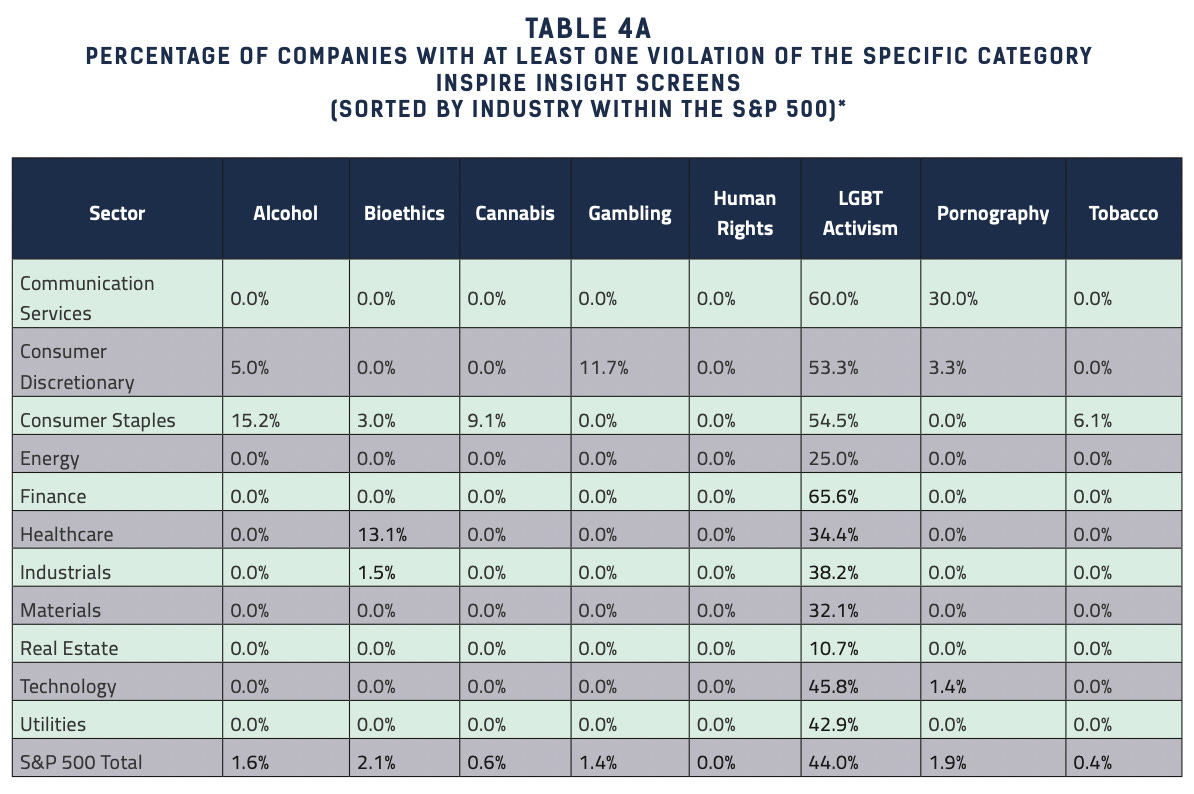

Despite Meta’s new rules, even they aren’t BRI-safe. Among other violations, BRII downranked them because of a 2024 video posted to LinkedIn captioned, “This PRIDE month, we’re proud to amplify the voices and stories of our Meta employees who are shaping a more inclusive world.” And Meta isn’t alone: Coca-Cola was written up for donating $100,000 to The Trevor Project—a suicide prevention organization for LGBTQ youth—and Amazon was downranked for having an LGBTQ category on its marketplace. In fact, almost half of the S&P 500 is a no-go for Christian investors because of their so-called LGBT activism.

“What they're doing is demonizing an entire community,” says Wendy Via, co-founder and president of the Global Project Against Hate and Extremism. “[BRI] creates this false equivalency for discrimination against LGBTQ people and people of faith. It's just not the same. The gay community has worked for years and years to get folks the rights and the protections that they have earned and deserve. And so a company shouldn't be dinged for being inclusive.”

One of the most common reasons a company gets ruled out of BRI is when they have a high score on the Human Rights Campaign (HRC) Foundation’s Corporate Equality Index—a survey that measures workplaces on their LGBTQ policies and practices that is widely recognized as the gold standard metric for whether a company treats their queer employees well.

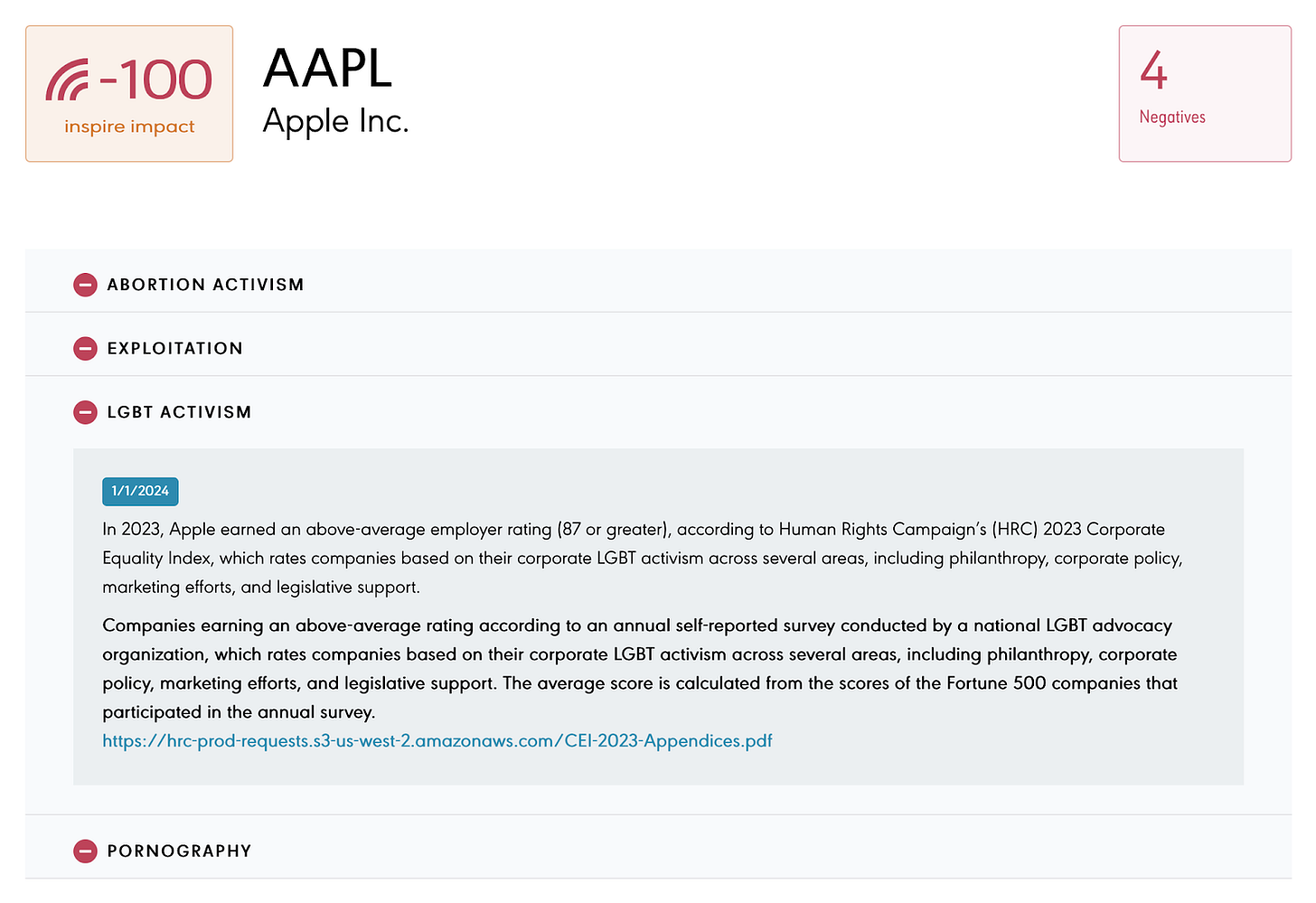

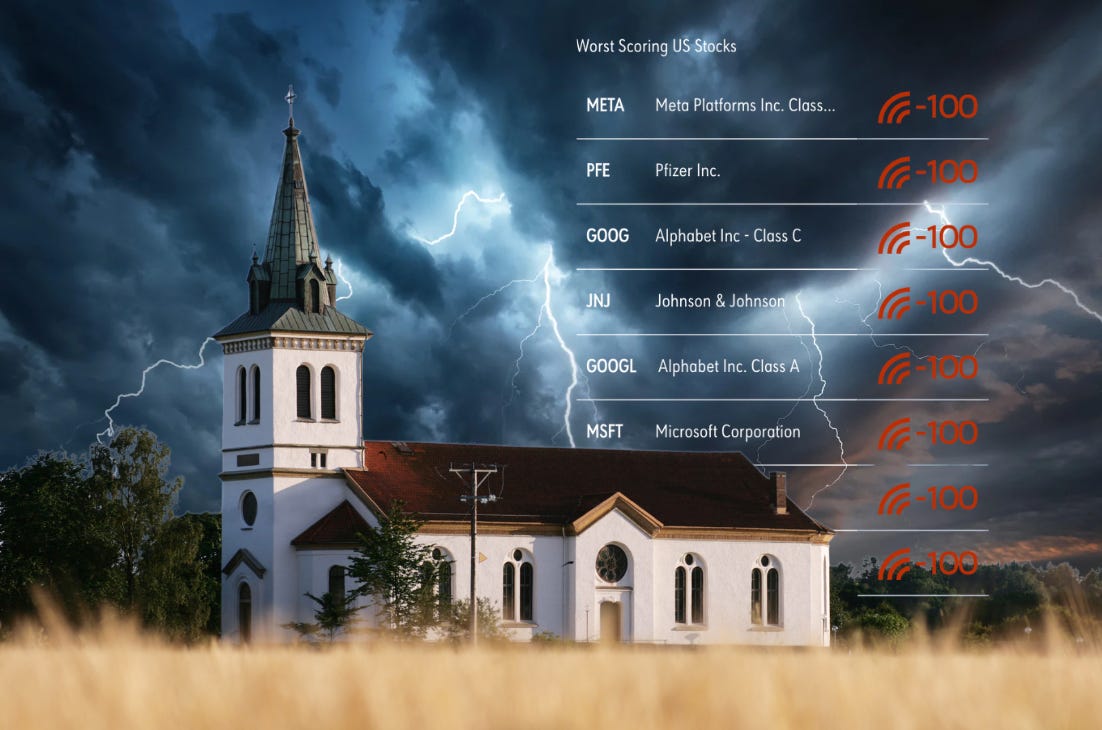

But for Inspire Investing, companies who scored “an above-average employer rating” on the HRC’s Index are dinged and receive a bad score for their so-called LGBT activism. Meta, Pfizer, Alphabet (Google’s parent company), Microsoft, Amazon and Apple all received the lowest score from Inspire Investing—a negative 100—for “earning an above-average rating from HRC.”

Part of corporate America's abandonment of DEI has involved no longer participating in the HRC’s survey. In the last six months, companies that announced they would no longer participate include Harley-Davidson and Lowe’s. And today, both companies hold positive scores from Inspire Investing, which is only possible when a company has no screening violations related to so-called LGBT activism or other categories they deem anti-Christian.

“There’s many things in the [Index] that are just frankly required legal mandates; you have to do certain things,” says Netzly, who says HRC has “encouraged hate-filled messages towards people of faith.” But when it comes to something like celebrating pride, Netzly asks, “Has Apple sponsored a Focus on the Family parade? I don’t think they would do that [and] that’s an example of taking sides in an issue.” Focus on the Family is an organization that has advocated for conversion therapy. The Southern Poverty Law Center has described them as one of a "dozen major groups [which] help drive the religious right's anti-gay crusade."

In an email to Uncloseted Media, HRC Spokesperson Jared Todd challenged Netzly’s notion that being pro-LGBTQ means you are anti-Christian. “Two things are true: Diversity and inclusion efforts are not a zero-sum issue; and LGBTQ+ people of all backgrounds hold jobs that are housed in workplaces across the country. That’s why policies and practices based in DEI, alongside active participation in surveys like the Corporate Equality Index, are so vital to a company’s long-term success in achieving their business goals and ensuring top talent attraction and retention,” he writes.

Despite the recent DEI exodus, Todd noted that this year, HRC surveyed a record-high 1,449 participants—nearly 5% growth from the previous year. Todd also pointed to data from 2024 that found 60% of people say an inclusive work culture with a well-supported diversity program is critical to attracting and retaining them as an employee—up 9 points from 2022.

“I think the real problem is how these companies are defining Christianity and biblically-based thinking,” Via told Uncloseted Media. “They are viewing Christianity and a biblical worldview in a very narrow way that the majority of Christians do not agree with,” she says.

The Origins of BRI

“Biblically responsible investing was sort of an evolution from the environmental, social and governance (ESG) movement,” says Saunders, who conducted a 2023 study exploring BRI. “This was a faith-based application of [it],” he says, adding that in recent years, BRI firms have separated themselves from ESG.

BRI was born in the 1990s when Arthur Ally founded the Timothy Plan. “At age 52, Mr. Ally was called by God … to launch America’s first pro-life/pro-family mutual fund,” reads a brochure on their website. When it launched, the firm screened for five core issues: abortion, pornography, alcohol, tobacco and casino gambling. It has since added additional screens aimed at the LGBTQ community to “preserve innocence [by] filtering out companies engaged in anti-family activity” and exclude “companies actively profiting from and normalizing the vulnerabilities of … sexual impurity, or attempting to redefine God’s Word.”

The Timothy Plan did not respond to multiple requests for comment.

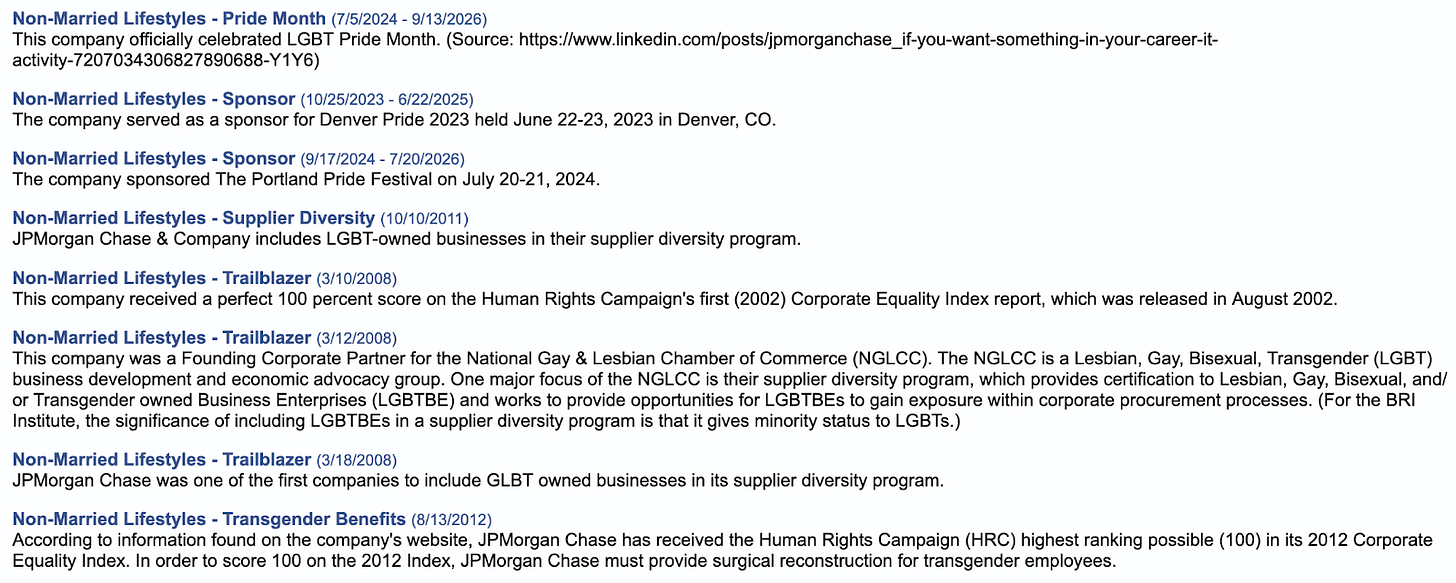

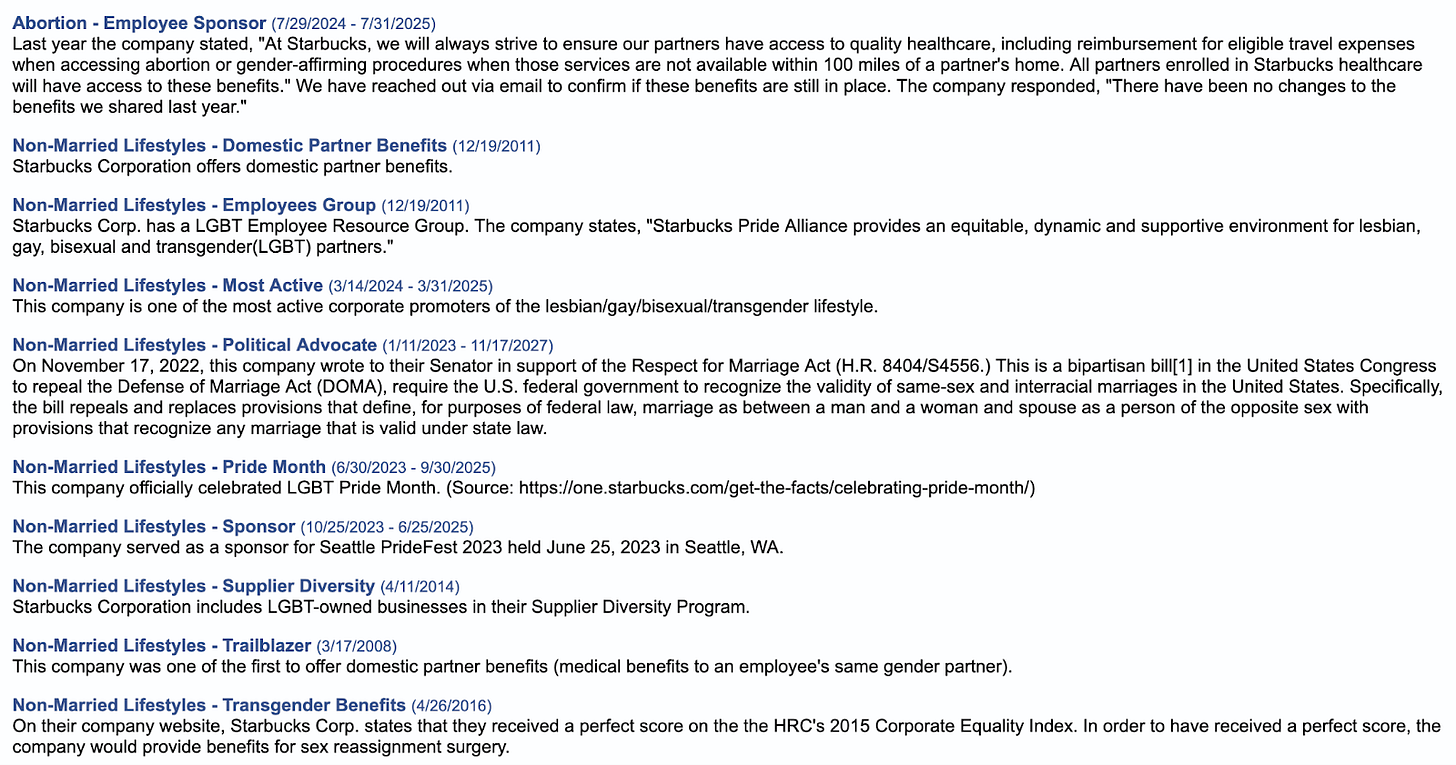

When it comes to filters, the Biblically Responsible Investing Institute’s are the strictest, according to Saunders’ research. Their sprawling screens—67 in total—are broken down into 13 categories, including abortion, alcohol, anti-family activity, contraceptives and non-married lifestyles.

“We do not hate any person who self-identifies as LGBT,” Stephen duBarry, president of BRII, told Uncloseted Media in an email. “We are taught by Christ that every human being is our neighbor, who we are to love as much as we love ourselves. At the same time, we also believe that LGBT behavior is sinful, disordered and ultimately self-destructive. We are convinced this is what the Bible teaches, and this is also how a broad consensus of Christians have understood scripture for roughly two millennia. It is precisely because we love our neighbor that we seek to divest from the promotion of all forms of behavior that we believe to be harmful.”

Saunders’ research found the most commonly violated BRII screen is related to LGBTQ equality which is filed under “anti-family activity” and “non-married lifestyles.” Each filter carries a fixed “failure period,” ranging from 1 year to 100 years, designating the length of time a company is excluded from BRI investing.

For example, because Apple celebrated pride in 2023 and 2024, they are excluded from BRI for 54 months until at least September 2026. Since they were “one of the first [companies] to offer domestic partner benefits (medical benefits to an employee’s same gender partner),” Apple is excluded for 100 years, lasting from March 17, 2008 until March 2108. Yes, as in the 22nd century.

DuBarry notes these exclusions could be dropped if Apple were to “meaningfully address BRII’s concerns.”

The full list of Apple’s BRII violations is vast. The company received anti-family activity violations for promoting LGBTQ-themed podcasts, audiobooks, and TV shows on iTunes and AppleTV. They received a similar violation because of a post on X promoting an interview with Scissor Sisters gay pop icon Jake Shears and nonbinary musicians Lava La Rue and I. Jordan.

“[BRI] tries to point out companies that violate human rights … [but] excludes or prevents companies that are trying to be activists in that area,” says Saunders. “It certainly could seem to be doing the opposite of what it intends to do in some areas.”

BRII Violations for LGBTQ-related Company Activities:

The Growth of the Industry

Since the Timothy Plan launched in 1994, at least six other Christian investment firms have joined the scene. Some of these firms, including Inspire Investing, have their own network of specialized financial advisors who target Christian investors and guide them on how to follow BRI practices. The ability to grow clientele and audience is supported by a media ecosystem that includes TV ads, podcasts, videos, daily livestream shows and books that explain why you, a good Christian, should join in.

Timothy Plan TV ad. / Financial Issues Stewardship Ministries livestream Feb. 11, 2025

One podcast, Christian Financial Perspectives, explains in an episode entitled “Voting Christian, But Investing Woke?” that “millions of conservative Christians are supporting woke agendas through their mutual funds or ETFs.” Host Bob Barber explains that “we [conservative Christians] want to have a voice not only in the nation, but we want to have a voice in our city, our state, and how our country [is] run.” The goal? Enough control of the country to fight “liberals” who “want a free reign for the LGBTQIA+.”

“It’s kind of like the whole poop in the brownie stories,” says co-host Shawn Peters, resorting to a crude metaphor for why Christians can’t simply take any faith-based approach and must follow BRI. “If somebody offers you a brownie and they say, ‘Oh, there’s a little bit of poop in there.’ Well, how much poop is okay in the brownies for you to still eat them? I think most people would say, ‘Now that I know there’s poop in the brownies, I don’t want to eat them,” he says, explaining that no matter how small or indirect, a good Christian steward wouldn’t let their money touch companies that support LGBTQ or other screening measures in any way.

BRI Penetrates All-American Institutions

Companies with BRI violations transcend all institutions in American society. UnitedHealth Group is ruled out for offering health insurance that covers gender-affirming care for trans people; JP Morgan Chase took a hit for its foundation’s contribution to LGBTQ causes like the National Queer Asian Pacific Islander Alliance and the Chicago Gay Men’s Chorus; Starbucks was wrist slapped for sponsoring Seattle’s PrideFest in 2023; and even Electronic Arts—creator of The Sims—was dinged for including queer characters in its games.

Via sees parallels between the world of BRI in investing and the broader goals of right-wing Christianity. “The Christian nationalist movement in the U.S. is very much trying to break that separation of church and state in our government and they are trying to influence entertainment and media. And now we're looking at financial institutions. It is alarming that there is such a concentrated effort in all parts of society from a minority of a minority of Christianity,” she says.

Like most conservative Christian movements, the next biggest issue for BRI is abortion. Companies are ruled out of BRI for offering their employees benefits like insurance that covers abortion and abortion-related travel. For Target and Walmart—who have both recently ditched their DEI efforts—even simply selling the morning-after pill landed them a violation.

Real-World Impact

The world of BRI has a real-world impact on the policies of some of America’s largest companies.

Uncloseted Media has obtained four shareholder resolutions from Inspire Investing targeting efforts to curb hate speech and anti-discrimination guidelines dating as far back as 2023—including one resolution that Apple shareholders rejected at their annual meeting on Feb. 25.

Uncloseted also obtained over 20 letters supporting similar resolutions submitted by Inspire Investing between March and May of last year to many companies that have since curbed their DEI policies, including Walmart, Amazon, Citibank, Morgan Stanley and JP Morgan Chase. “We've been in conversations with a number of [companies], you know? Tractor Supply, John Deere, kind of on down the list. Robby Starbuck is a part of our coalition,” says Netzly.

In a resolution submitted to Apple, Inspire Investing criticizes the company’s policies, stating it supports “non-profits that are … actively attacking free speech and religious freedom.” This includes groups like the Southern Poverty Law Center (SPLC), a nonprofit specializing in civil rights and well-known for its hatewatch list that flags companies that “monitor and expose the activities of the American radical right.”

Another resolution submitted to Verizon says companies that promote DEI initiatives “replace rich cultural and ideological diversity with a monolithic focus on group identity” and that terms like “microaggressions” and “hate speech” serve to “punish certain political and religious views.”

Where they can’t wield their own shareholder power, Inspire Investing assists outside partners, like the conservative think tanks National Center for Public Policy Research and Bowyer Research, by sending letters of support for resolutions that target DEI policies and so-called viewpoint restriction rules that limit hate speech against marginalized groups.

In the week leading up to the presidential election, Inspire worked with SPLC-designated anti-LGBTQ hate groups like Alliance Defending Freedom—which has voiced support for conversion therapy and has been influential in anti-trans legislation. The two organizations, alongside “a group of influential investors with over $65 billion in assets under management,” worked together to send letters to Fortune 1000 companies “urging them to avoid or roll back their DEI policies” in response to members of Congress who were asking those companies to “defend” DEI values.

Alliance Defending Freedom did not respond to Uncloseted Media’s request for comment.

“DEI has become synonymous with taking sides, and particularly a leftist side, alienating and even oppressing those who have different viewpoints,” Netzly told Uncloseted Media. “Some call it reverse discrimination, call it what you will, but that’s what [it has become] in practice,” he adds.

The Trump Effect on BRI

Leaders in the BRI space believe the Trump administration will help their industry blossom. Netzly wrote in a blog post that “President Trump’s 2025 agenda has provided a rare and compelling alignment with the principles of biblically responsible investing.” In just six weeks, “New leadership at federal agencies … and other reforms create{d} a legal environment where Christian businesses can flourish.”

John and David Schneider, hosts of the Queer Money Podcast, urge the LGBTQ community to leverage their own financial power. They say the whole goal of BRI is to suck investing dollars from companies that are positive for the community and wield those investments for their own political gains.

“One of the things that our community doesn’t have that the Christian right has is one thing they coalesce around, right? They coalesce around biblical values and understand how they apply that in their lives,” says David Schneider. “We’re exactly in the place that the Christian right wants us to be,” he says. “Stressed out, spread out and unorganized.”

When it comes to fighting back, “We have more power than we think we do. We have been trained to believe that we are powerless,” says John Schneider, urging queer people to think more strategically about their money. While the LGBTQ community doesn’t agree on everything, we do have one thing in common: protecting our rights. And there are plenty of queer people with investments to leverage in support of that—be it a retirement plan, stocks or simply a college fund or, at the very least, how you spend your money.

As BRI continues to boom, Netzly believes companies like his will continue to have more influence to use shareholders to push corporate powers away from LGBTQ-inclusive social policies.

Wendy Via of the Global Project Against Hate and Extremism says that as the BRI movement grows, intolerance towards the LGBTQ community may increase as well.

“The idea that we're going to take our society backward and use finances as a way to do it. I mean, I think it's appalling,” she says.

If objective, nonpartisan, rigorous, LGBTQ-focused journalism is important to you, please consider making a tax-deductible donation through our fiscal sponsor, Resource Impact, by clicking this button:

So are there any groups that are the antithesis to this? I’d be interested in a “Anti-biblical” investing firm.

Why do christians motivate things that Christ himself would and does command them to give sanctuary to. Christ would expect DEI not shun it