In the Hidden World of Donor-Advised Funds, Anti-LGBTQ Groups Make Big Money

Donor-advised fund sponsors like Fidelity Charitable and Vanguard Charitable have given tens of millions of dollars to anti-LGBTQ hate groups.

When was the last time you gave money to charity? In 2023 alone, Americans gave an eye-watering $557 billion to around 2 million nonprofits, with almost a quarter of that figure—$134 billion—donated to religious causes.

But who are the individuals and foundations behind these religious gifts? Well, if you’re using a donor-advised fund (DAF), it’s pretty much impossible to trace the money back to its donor.

What is a DAF?

In 2023, there were roughly three million DAF accounts. To open an account, you need a DAF sponsor. Most large investment funds, like Bank of America, Vanguard, and Fidelity, have charitable arms that act as sponsors. Donors give their money to their DAF sponsor and get immediate tax breaks from their investment. From there, the donor tells the sponsor which charities they’d like their money to go toward, and the sponsor advises the donor about whether this is the right move and executes the grant accordingly.

For most donors, the biggest perk of giving through a DAF is the various tax breaks they can receive, including immediate deductions. But what allures some wealthy donors is the anonymity DAFs provide, especially if they don’t want the public to know they’re giving to nonprofits with unconscionable track records on LGBTQ issues, which happens more often than you might expect.

In fact, Uncloseted Media has discovered that DAF sponsors—both religious and mainstream—are stewarding millions into conservative Christian nonprofits that have been designated as anti-LGBTQ hate groups by the Southern Poverty Law Center (SPLC) and PFLAG.

The Surprising Funders of Hate

Over the past five years, the biggest DAF sponsors include Fidelity Charitable; Vanguard Charitable; and DAFgiving360, formerly Schwab Charitable. They gave at least $37.8 million to anti-LGBTQ nonprofits who advocate in favor of conversion therapy and against gay marriage and are spearheading the rollback of many transgender rights.

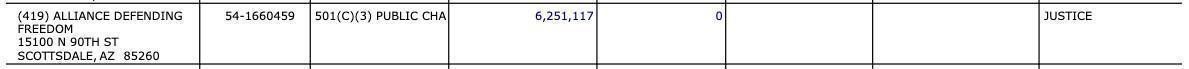

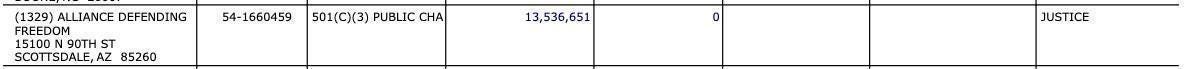

Fidelity Charitable, the largest of the three sponsors, gave $20 million to these groups between 2019-2023, including over $1 million to the Alliance Defending Freedom (ADF) and over $2 million to Focus on the Family in the financial year ending in June 2023. DAFgiving360 gave over $2 million to both ADF and Focus on the Family in the same time period.

In an email, DAFgiving360 told Uncloseted Media they are a separate legal entity from Charles Schwab and that “grants recommended by donors do not reflect the values or beliefs of DAFgiving360, Charles Schwab & Co., or its management.” They encourage anyone with concerns to contact the IRS or state regulators.

All three of these DAF sponsors also made grants to Liberty University and Oral Roberts University, two notoriously anti-LGBTQ conservative Christian universities known to practice conversion therapy.

“If somebody on [these DAF sponsor’s] staff said the kinds of things that ADF or others say publicly, [they] would not continue to have them on [their] staff or board. How can [they] justify supporting that through a grant?” Dan Petegorsky, a consultant at the Institute for Policy Studies, an independent, progressive think tank, told Uncloseted Media.

He says it’s “hypocritical” that these companies pose as allies in the public square but, behind closed doors, funnel money into nonprofits that are coming after the LGBTQ community. Schwab, for example, has celebrated pride and said, “Employees are proud to support each other every day through a culture of inclusion.” Meanwhile, Fidelity advises clients on how to give equitably, publicly telling their donors that “there remain persistent disparities in support for vulnerable populations, specifically … LGBTQ+ people.” Still, both charities have greenlit millions of dollars toward undermining queer and trans rights.

Christian Faith-Based Giving

But it’s outside of these mainstream DAF sponsors where the money really flows, nowhere more so than through the National Christian Foundation (NCF), the monolith of Christian faith-based giving.

The organization was founded in 1982 by Evangelical author Larry Burkett, financial planner Ron Blue and tax lawyer Terry Parker.

Through the years, they have received donations from notorious anti-LGBTQ billionaire David Green, the founder and CEO of Hobby Lobby, and have been described by Inside Philanthropy as “the single biggest source of money fueling the pro-life and anti-LGBT movements.” They also claim “the sanctity of life, sexuality, gender, and marriage” are all values essential to fulfilling their Christian ministry, according to Accountable for Equality, an organization that researches “anti-LGBTQ extremists.”

NCF also asserts that “God created man in His own image; male and female,” ignoring the reality of trans and gender non-conforming people. In 2024 alone, NCF made $2.6 billion worth of grants to 36,560 charities. Through the years, they have given at least $173 million to ADF, $126 million to Focus On The Family and $40 million to Family Research Council.

Petegorsky says that NCF knows "they are a home for ideologically conservative Christians." And a popular one at that. According to research by the Institute for Policy Studies, NCF is the 13th biggest charity in the country as of 2023, one rank above Habitat for Humanity. Fidelity Charitable and DAFgiving360 were the first and third charities with the largest contributions in America, respectively.

Anonymity Motivates Folks to Give Through DAFs

“[DAFs are] by far the most widespread kind of donation vehicle for wealthy Americans at this point,” according to Alex Kotch, an investigative journalist who has extensively covered DAFs that give to anti-LGBTQ, anti-Muslim and other hate groups.

“[The anonymity] is a big motivation for donors who want to give to the various groups and don't want to actually be publicly known as a sponsor,” says Kotch. In other words, if a donor recommends a gift to ADF through their DAF, it is almost impossible to trace that gift back to the individual.

This is because, as with any investment fund, DAF sponsors are under no obligation to report who their clients are. On the other end, they must—like any grantmaking organization—disclose all nonprofits they give money to.

The groups these DAFs are giving to have had significant success in rolling back LGBTQ rights. ADF is known for their legal work stripping LGBTQ and reproductive rights in the courtroom, including writing the legal framework that helped overturn Roe v. Wade in 2022. Focus on the Family is a conservative Christian media network that has called gender dysphoria a “developmental crisis” that “is seemingly associated with ‘peer contagions’ such as social media influencers,” a theory that has been consistently debunked. And the Family Research Council “believes that homosexual conduct is harmful to the persons who engage in it and to society at large, and can never be affirmed.”

Other anti-LGBTQ hate groups that receive funding from NCF include the American Family Association, Concerned Women for America and The Heritage Foundation—the group best known for penning Project 2025.

In an email, Jeff Johnston, an issues analyst for Focus on the Family, told Uncloseted Media: “Our ministry is not concerned with how PFLAG labels us. … We strongly believe what Christianity and Scripture have always taught: God made humans in His image – male and female; marriage is the union of a husband and wife; and children do best when raised by their married mother and father.” He added that “LGBT-identified individuals have the same rights as everyone else in our country,” which is false.

NCF, ADF and Family Research Council did not respond to Uncloseted Media’s request for comment.

How Donations to Hate Groups Get Greenlit

But how is this allowed? Kotch says that while DAF sponsors feign a lack of decision-making power about where funds are directed, they have more authority than they let on. “I get the same boilerplate responses about how it’s not up to them, it’s up to their clients,” he told Uncloseted Media. “That’s a lie.”

Here’s how it actually works: Once a DAF receives a gift from its donor, they legally own the money. Per its name, the donor must then advise the DAF sponsor on where to donate. But the ultimate decision is up to the DAF sponsor, not the donor.

“Let’s say you had a bunch of money you were giving out and you’re saying ‘Well, no, actually I don’t really have the power to give it out, it’s my grandma who gave it to me and she’s calling the shots, so I don’t have any control,'” explains Kotch. “But really, you own it.”

And it’s the same for DAF sponsors in that they have the final say. While DAF sponsor policies differ slightly, they all carry one key theme: As long as you’re donating to a legitimate 501(c)3 nonprofit that is in good standing with the Internal Revenue Service (IRS) and your suggested donation meets their guidelines, they will approve the grant. But hidden away in a policy document, DAFgiving360 says they “may deny grant recommendations that do not meet approved criteria or for any other reason.”

Fidelity follows a similar set of rules but adds that the grant must be “in all other ways consistent with Fidelity Charitable policies.” Vanguard Charitable says their team “researches, reviews and sends the grant for you,” but a request might be denied: “Most often it's about the legalities surrounding granting itself, such as impermissible benefits.”

Todd Sears, founder and CEO of Out Leadership, a consultancy firm that supports LGBTQ business leaders, says it’s more complex. “Of course it’s terrible that people are funding hate groups,” he says. “But people in our community need to understand that companies have a [financial] obligation to the donors themselves.”

“They're not going to risk losing that client for the overall business by denying the client a grant they want to make,” Petegorsky told Uncloseted Media. “It’s a huge dilemma for them, and it’s subject to a lot of political push and pull.” Occasionally, there is pressure that forces sponsors to halt certain grants. For example, last year, Fidelity blocked donors from giving money to the United Nations Relief and Works Agency for Palestine Refugees, a charity which “provide[s] assistance and protection for registered Palestin[ian] refugees.”

NCF wields this same power in limiting grants to organizations that go against their statement of faith, corroborating the theory that they have at least some level of control. Even though they have no specific guidelines for donating to LGBTQ causes, one grantmaking guide advises clients they can contribute to “organizations whose mission is to celebrate the sanctity of marriage by strengthening the bond between husband, wife, and God,” and its grantmaking form states that “NCF reserves the right, in the exercise of its sole and absolute discretion, to approve or disapprove any recommendations for grants or distributions.”

Even though mainstream DAF sponsors won’t intervene politically in specific grants, “They will express their values in a way that they think positions them to best expand their business and hold their clients,” says Petegorsky. “And those [values] are based on the shifting political climate, not their core values.”

“I think they need to be called out as hypocrites and challenged on it,” Petegorsky adds. “It’s a total contradiction.”

If mainstream DAF sponsors stop allowing donations to anti-LGBTQ groups, they risk losing a conservative Christian donor base, Petegorsky explains. “The ideological donors who want to make those grants will say, ‘Well, fuck it. Why should I be putting my money into Fidelity anymore if they're not going to fund what I want? I'm just going to put my money into NCF because they'll do what I want.’”

When asked how to strike a balance between donor interests and protecting marginalized communities, Sears says, “Education, that's how. … If you shame somebody, they’ll never forget it. … People can always change their mind if we tell them the right way.”

What Can Be Done?

While there are plenty of folks who intentionally donate to anti-LGBTQ nonprofits, John Schneider, co-host of the Queer Money Podcast, argues a lot of donors aren’t aware of the work they are funding. “They don’t actually go on the websites of these charitable organizations and dig deep into where [their] money is going.”

So what can be done about DAFs funneling money to hate groups? When it comes to conservative faith-based DAF sponsors like NCF, it is hard to imagine a world in which they would limit giving to anti-LGBTQ hate organizations. “It’s a sauce for the goose, sauce for the gander here,” says Petegorsky. “A lot of those organizations that we think of as doing the devil’s work, others think of doing the Lord’s work.”

And for mainstream investment firms? “I think they bear responsibility,” says Kotch, adding that DAF sponsors could draw on existing SPLC and PFLAG hate group designations to evaluate nonprofit grant recipients. New research by the DAF Research Collaborative found that, out of 128 DAF sponsors, 75% had declined grants to hate groups as defined by a third party or internal list and 41% declined grants that do not align with their values.

“But if [the major DAF sponsors] don’t want to just trust one source, there’s a lot of willing partners out there who would love to form a coalition and evaluate which groups are considered hate groups,” says Kotch. “They just don’t want the work done. … They just don’t care.” This unwillingness to take a stand means that hundreds of millions of dollars will continue to funnel into anti-LGBTQ efforts in the U.S. and internationally.

“I think the easiest solution is just to talk about it,” says Sears. “Say out loud ‘Hey y’all, I’ve been a Schwab or Vanguard or Fidelity client for 30 years, and I just found this out. Did you know?’” Even take it to your financial advisor or broker and ask them to look into it. “That’s people using their own platform saying, ‘I’m a client,’ because companies ultimately respond to their clients,” he says.

Another way these donations could be regulated is through Congress and the rules they impose on the IRS, who is responsible for certifying the anti-LGBTQ hate groups as tax-exempt, 501(c)3 nonprofits. “In other words, [regulating] which organizations are subsidized by taxpayers,” says Kotch.

Under the Trump administration, and with people like House Speaker Mike Johnson having written things like “homosexual marriage is the dark harbinger of chaos and sexual anarchy that could doom even the strongest republic,” it’s unlikely we’ll see anti-LGBTQ groups restricted from tax-exempt status by Congress anytime soon.

“I don’t think it’s unreasonable to say, ‘Okay, it’s a thorny issue, but at the same time we need to develop standards,’” says Kotch. “People have a duty to try and reduce the hate in their states, and especially the funding of that.”

****Liberty University, Oral Roberts University, Fidelity Charitable and Vanguard Charitable did not respond to Uncloseted Media’s request for comment.

If objective, nonpartisan, rigorous, LGBTQ-focused journalism is important to you, please consider making a tax-deductible donation through our fiscal sponsor, Resource Impact, by clicking this button: